In recent years, particularly since the 2008 financial crisis, more clawback clauses have been applied to employment contracts as a result of long-term variations of financial instruments. This provision became a tool for controlling employee compensation and preventing fraud in executive officers after 2008.

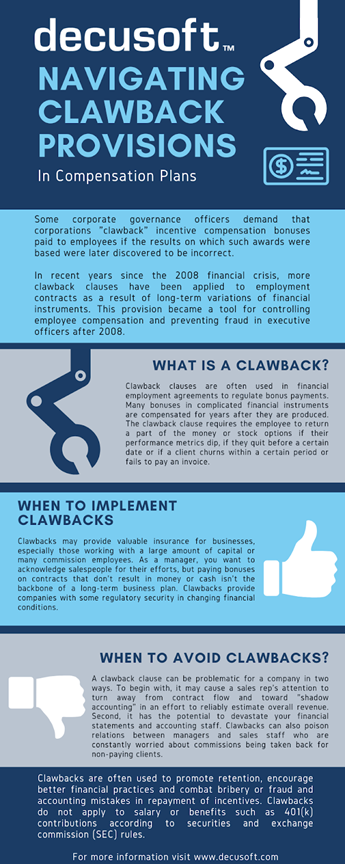

Some corporate governance officers demand that corporations “clawback” incentive compensation bonuses paid to employees if the results on which such awards were based were later discovered to be incorrect. For years, the adoption of Dodd-Frank rules regarding clawbacks have been postponed. In the meantime, most organizations’ compensation committees and sound corporate planning strategies have put in place policies to prevent this. When the Dodd-Frank rules are finalized, these practices will need to be amended, especially with regards to the forms of achievement restatements and the handling of long-term bonus awards. So, what is a clawback clause, and how does it work?

What is a Clawback Provision?

Clawback clauses are often used in financial employment agreements to regulate bonus payments. Many bonuses in complicated financial instruments are compensated for years after they are produced. The clawback clause requires the employee to return a part of the money or stock options if their performance metrics dip, if they quit before a certain date or if a client churns within a certain period or fails to pay an invoice.

Financial reporting institutions found that similar to insurance claims for “Acts of God,” they wanted to protect their payout package for non-performing employees. Mortgages or mortgage-backed securities account for the majority of these clawback provisions. With the rise of derivatives markets, the clawback clause has become more useful in risk management. Should an investment decline in value, an employee become involved in a scandal or get fired for misconduct, the organization can reclaim a portion of the bonus, sometimes including interest.

You don’t have to be accused of misbehaving to be subjected to a clawback. Clawbacks are often used to promote retention, encourage better financial practices and combat bribery or fraud and accounting mistakes in repayment of incentives. Clawbacks do not apply to salary or benefits such as 401(k) contributions according to securities and exchange commission (SEC) rules.

When to implement Compensation Clawback Provisions?

In 2010 the Corporate Finance Institute found that clawback provisions were present in 82% of employment contracts. Clawbacks have become more popular over the years especially in financial institutions like hedge funds, investment banks, and other businesses in the finance industry including many Fortune 100 public companies and those on Wall Street.

A proposed rule to the enactment of The Dodd-Frank Act of 2010 expanded US clawback rules in 2015 by allowing employers to reclaim incentive-based bonuses in the case of an accounting restatement after a triggering event, usually mistake, fraud, if a stock price dips or another event. The difference between the initial and amended payout will be “clawed back” so to speak for noncompliance.

Clawbacks may provide valuable insurance for businesses, especially those working with a large amount of capital or many commission employees. As a manager, you want to acknowledge salespeople for their efforts, but paying bonuses on contracts that don’t result in money or cash isn’t the backbone of a long-term business plan. Clawbacks provide companies with some regulatory security in changing financial conditions.

Clawbacks also encourage sales reps to follow up with their clients and maintain a high level of customer satisfaction. This is particularly beneficial for subscription-based businesses that see a high level of churn from canceled subscriptions. Consider the case of a corporation that has implemented a one-year clawback rule. If a customer cancels their plan within a year period of signing up, the sales representative must receive a refund of any or more of their commission. This helps sales reps to follow up with buyers to ensure they are satisfied with the product and to turn their attention on consumers who will truly benefit from the items or services being offered in the long run. It also encourages regulators to steer clear of candidates that aren’t a good match for the business.

When to avoid clawbacks in compensation packages?

A clawback clause can be problematic for a company in two ways. To begin with, it may cause a sales rep’s attention to turn away from contract flow and toward “shadow accounting” in an effort to reliably estimate overall revenue. Second, it has the potential to devastate your financial statements and accounting staff. Clawbacks can also poison relations between managers and sales staff who are constantly worried about commissions being taken back for non-paying clients.

When an account is booked, for example, businesses must capitalize fees and use an accrual model for commissions. It’s possible that a public corporation would have to restate earnings accounts if a commission is amended retroactively, affecting previous accruals. Furthermore, in a world where a large input variable, such as commission costs, can be updated at any time, financial forecast models would be less useful. Clawbacks rarely amount to much difference in payouts and do not provide much benefit to the company.

Incentive Plans and Clawback Policy Best Practices

If you plan to go ahead with a clawback scheme, you should have the following best practices in mind. Be sure you’re not breaking any workplace rules in your state by consulting with your legal staff. As the notorious $150 million Oracle case revealed, lawsuits can be very expensive. The clawback was designed to manage liability and prevent potential fraud. If a salesperson knew ahead of time that his deals would lose money and that he would have to return a percentage of the gains, he would be more careful when measuring their worth. The clawback clause guards against both deliberate and accidental accounting mistakes and should be implemented carefully and consequences clearly communicated to employees.

Examples of clawback provisions

Medicaid recovery: Medicaid is permitted to reclaim funds paid for the healthcare of a Medicaid beneficiary who has died and thus no longer requires the services. Many states want to recoup Medicaid funds spent on long-term treatment, such as nursing homes, in advance.

Mortgage lending: To reclaim funds from unprofitable home loans, most banks use clawback clauses especially during the pandemic.

Life Insurance: If a policy is canceled, a clawback clause will cause the incentives and premiums earned in the past to be returned.

Executive compensation agreements: If an executive breaches an arrangement and moves on to work with a client or competing business within a given amount of months as specified in the deal, the executive issuers will be obliged to repay the company that formerly hired them under clawback clauses.

Pensions: Once it is discovered that there has been any illegal operation or intelligence suppression or adulteration, pensions will be clawed back.

Dividends: Dividends will be clawed back under some cases, such as bankruptcy.

Government contracts: If a contractor fails to follow defined quality specifications or fails to meet the contract’s conditions, clawback rights can be exercised against the contractor.