What is a compensation system?

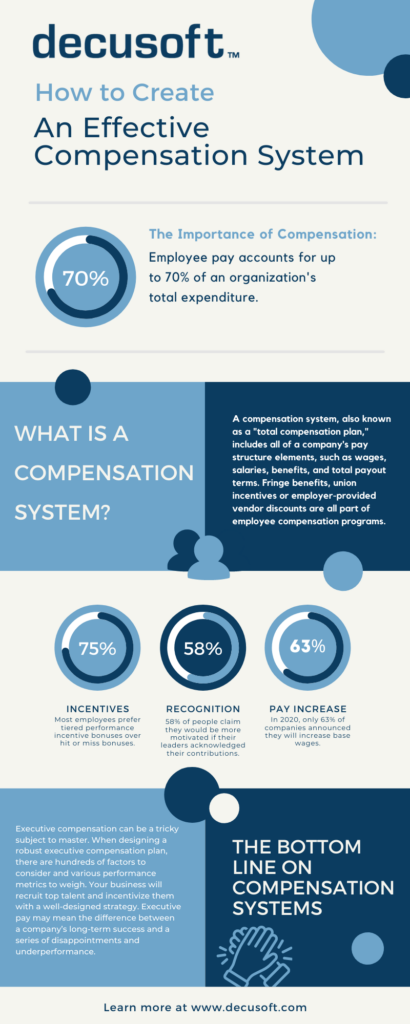

A compensation package, also known as a “total compensation plan,” includes all of a company’s pay structure elements, such as wages, salaries, benefits, and total payout terms. Fringe benefits, union incentives or employer-provided vendor discounts are all part of employee compensation programs.

When designing a robust executive compensation plan, there are hundreds of factors to analyze and various success metrics to weigh. Your company will recruit top talent and better incentivize them with a well-designed compensation strategy. A robust compensation structure may be the difference between a company’s long-term growth and a series of disappointments and below benchmark performance. Check out our Complete Guide to Compensation Management if you want to read more about aspects of executive compensation.

Your organization must have a fair compensation package in place to attract and retain top performers. A well-thought-out compensation philosophy that is kept current, competitive, and compliant with labor laws supports a number of critical aspects of your business including:

Plans for the future

Employee engagement and employee performance

Budgeting and company objectives

Competition in the industry

Operational requirements and job descriptions

Performance management – total compensation strategies for top talent retention

Salary, hourly, commission, and incentives are the four main direct forms of compensation. Indirect compensation, such as bonuses, benefits packages and equity-based programs, are just as important a part of the pay structure as direct compensation.

Why do companies need a compensation plan?

In 2021, companies must develop a solid comprehensive compensation strategy. A well-researched and effective compensation strategy helps you achieve pay equality and other important targets while still attracting productivity and rewarding current employees and executives for their hard work. Designing an appropriate compensation system will also aid in attracting and retaining talent, as well as allowing you to be flexible as business dynamics shift. Compensation management is one of the most difficult tasks for an HR department or compensation planning team to undertake, particularly in highly competitive and controlled industries like financial services.

To stay competitive in their industry and to attract and retain top talent, businesses need a well-thought-out compensation system. Employers who pay their workers whatever they believe they should be paid would eventually fall behind their rivals in the talent game. In addition, handling a workforce without a set budget is a form of insanity.

Employee pay accounts for the majority of a company’s net payroll expenses. Employee pay accounts for up to 70% of an organization’s total expenditures, according to Deloitte analysis. Compensation administration has an effect on an enterprise, and business owners and administrators, particularly human resource experts, should be mindful of this. You will help choose the best pay management solution for your company if you understand how compensation management impacts your firm.

Base salary compensation

A fixed wage paid to an executive for services rendered is known as a base pay. Individuals’ base pay is a reliable source of revenue, even though no bonus is paid, and is normally fixed at the start of the year. This is often discussed during the interview process and can be negotiated based on job description and salary range. The executive officer’s base pay ensures stability and predictability of revenue for day-to-day expenses. The basic pay is normally a small percentage of the maximum gross compensation package in an executive compensation scheme. However, since target annual and long-term benefits are often presented as a percentage of salary, adjustments are difficult to make.

Creating a Compensation Strategy

Your organization’s compensation package should not only consist of what you pay your employees or how much you cover in health insurance. An effective compensation management policy encompasses the entire philosophy of what your business values while striving to hit short and long-term goals. A robust compensation management plan is complete when it has a philosophy, strategy, guidelines for pay, policies, and processes.

Commission

A commission is a type of reward that is dependent on volume, revenue, or a predetermined level of performance. Paying commission is a term that refers to two approaches that are widely used. One calculation is dependent on the number of services or goods provided. The second method is based on the number of sales made. A real estate broker is an example of a worker who receives this kind of compensation: they sell a property and are paid for it. It doesn’t matter how long it took to sell the house or what job operations were involved; what matters is that the house was sold.

Bonus

Bonuses are provided to staff to inspire them or to improve their overall efficiency. This is a form of variable pay usually identified with sales professionals, who are often salaried or excluded employees. For example, if a salesperson reaches her quarterly goal by a certain dollar sum, she earns a commensurate bonus based on a fixed matrix. Bonuses may also be compensated for company success or when workers with special or particularly sought-after expertise occupy difficult-to-fill vacancies.

Incentive Compensation Plans

Employee retention and growth reward for individual performance are the most common reasons for incentive compensation plans, but they can also be used to increase employee recruitment, loyalty, commitment, and brand awareness. Are your incentive programs assisting you in attracting top players and motivating your workforce to meet your company’s usual objectives? Long-term success depends on having the right strategy at the right time. Incentive plans are an essential part of a holistic executive compensation strategy. Incentive plans help reward employees and executives for outstanding performance.

Indirect Compensation

Any fringe benefit that a company provides can be considered indirect compensation. It more often applies to the different forms of benefits that companies have, such as medical, dental, life, short- and long-term disabilities, and vision insurance. Another common source of indirect compensation is employee retirement plans, such as 401(k) plans which help employees with retirement savings.

Fringe Benefits

Today, pay practices have changed. Benefits, perquisites, and incentive pay account for a smaller proportion of total compensation for executives. The level of shareholder dissatisfaction far exceeds the importance of the benefits/perks provided, and the focus has shifted to “irritants.” Today’s perks are usually supportive of executives’ well-being and productivity. SERPs (Supplemental Executive Retirement Plans) that provide additional perks to senior executives, such as personalized retirement plans, are under fire. The use of excess/restoration plans is also permitted. Severance and change-of-control incentives are being used to address pay-for-non-performance problems.

These benefits can include:

Flexible time off

Flexible working hours

Stock options/equity

Fully covered healthcare

Matching 401k

Other retirement plans

Maternity and paternity leave

Transit reimbursement

Work from home

Unlimited PTO

Child care reimbursement

Learning seminars

Wellness benefits

Student loan reimbursement

Education reimbursement

Profit-sharing

Other employee benefits

The Bottom Line on Compensation Systems

Executive compensation can be a tricky subject to master. When designing a robust executive compensation plan, there are hundreds of factors to consider and various performance metrics to weigh. Your business will recruit top talent and incentivize them with a well-designed strategy. Executive pay may mean the difference between a company’s long-term success and a series of disappointments and underperformance. For more information on compensation, check out our whitepaper about using compensation software to reduce errors while saving time & money.