Annual incentive compensation programs represent an enormous opportunity for motivating employees and executives to do their best work. In this blog post, we discuss annual incentive compensation including recent trends, policy changes among shareholder advisory groups, and challenges compensation committees face. These challenges include goal setting, use of discretion, and payout curves. This blog post will help you understand how to craft your business incentive compensation plan and the potential challenges linked to implementing your plan.

What Is an Annual Incentive Plan?

An annual incentive plan is a plan for compensation that is earned and paid based upon the achievement of performance goals over a one-year period. These plans motivate performance and align executives’ work with the company’s short-term performance goals. In a well-designed compensation program, annual performance incentive compensation will include targets that support the company’s long-term business goals and strategy. Opportunities for senior management and senior executives are most often defined as a percentage of a base salary.

Targets created for annual incentive plans reflect market opportunities for the position and internal pay equity considerations. Long-term incentives can help executives maximize individual performance over not just months, but years. Additional compensation can come in the form of stock options and annual bonuses based on the level of performance.

What Defines a Well-Designed Incentive Program?

A well-designed incentive program will offer pay opportunities that closely align with responsible performance. There is a balance when delivering compensation – don’t place all your eggs in one basket. You should balance your plan to mitigate risk and reflect the work environment.

When designing an incentive program ask the following questions:

Internal:

- What will attract these executives?

- What will motivate these executives to continue their exemplary work?

- What will retain these executives?

- What will drive corporate performance?

- What will drive our executives to achieve strategic objectives?

- What needs to be accomplished this year and how can we leverage this with compensation?

External:

- What are our competitors doing?

- What are the trends or norms in our industry?

- What do our shareholders think of this plan?

- What do our other external partners and stakeholders think of our compensation plan?

Develop a Philosophy for Your Annual Incentive Compensation Plan

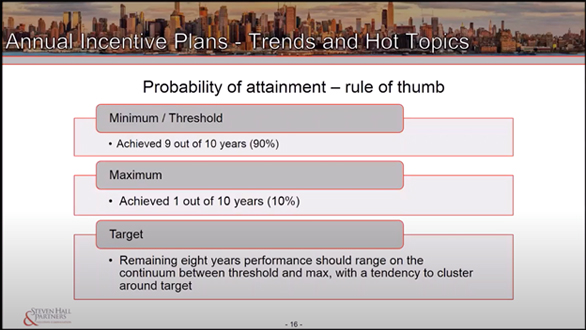

Your performance measures should be aligned with your business strategy and reflect the key drivers of corporate performance and shareholder value you are looking to achieve. You should create a clear line of sight for key employees that focuses on their efforts and maps their accountability. Let your goals be realistic. If your executives don’t think there is any way they can expect a payout based on your unreasonable expectations then your goal has failed.

The goals your organization sets should be achievable and motivational. These goals should represent sustainable performance relative to the benchmarks you have set. You should consider historical performance, volatility, and market expectations along with any future projects you are considering.

When creating a philosophy for your company’s incentive compensation plan ask these questions:

- How strong is the budgeting/business planning process?

- What will be paid for target performance?

- What is the threshold?

- What is the maximum?

- How do we set those parameters?

- What is the sweet spot for compensation?

Types of Performance Metrics

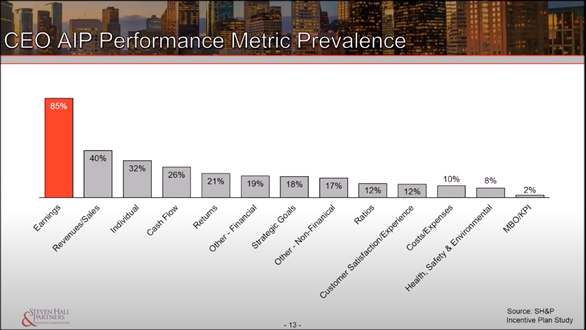

When creating a compensation plan it is important to take into account a myriad of performance metrics. Performance metrics fall into a few different categories such as financials which include earnings, net income, EPS (earnings per sales), and operating income. There are also revenue and sales from free cash flow and cash from operations compared to returns to consider. This includes returns on assets and returns on equity, which become more prevalent over the years. Ratios on these categories include operating income margin, EBIT margin, and efficiency ratio.

The non-financial aspect of performance metrics includes MBOs (management by objectives) and KPIs (key performance indicators.) We find these performance-based objectives can include a list of smaller metrics including diversity in the workplace, health and safety measures, development of talent, and more.

Some examples of non-financial performance metrics include:

- Individual goals

- Strategic goals

- Health goals

- Safety goals

- Environment goals

- Customer satisfaction experience

- Company performance goals

Over 85% of companies in the top 200 use an earnings metric including CEO bonus plans.

Source Stephen Hall & Partners

Earnings account for half of a bonus plan. The focus should be on earnings, and you will diversify out from that. Certain shareholders are also encouraged to implement sustainability and environmental factors in incentive plans.

Annual Incentive Plans – Trends and Hot Topics

Goal-setting challenges

Goal setting is under increasing pressure and scrutiny from shareholders and proxy advisory firms. There is a greater focus on the performance metrics that are driving growth. What are the estimates that are being provided to shareholders by both Wall Street and the company?

Ask these questions to determine the scope of annual shareholder incentive plans:

- How are these goals being set to compare to competitors?

- How do these metrics compare to industry benchmarks?

- How do these metrics compare to previous years?

Sometimes when making a projection or comparison based on current market performance it can be way off due to unexpected market conditions. It can be difficult to forecast future performance, which can make forecasts wildly inaccurate. Take more than 90 days if you need to create a projection and use sub-plans to further segment your incentive planning. We also recommend that you create a project deadline in year-over-year results.

Source Stephen Hall & Partners

Most annual incentive plans at public companies are structured to comply with IRC Section 162(m). In this structure, incentives paid subject to a shareholder-approved plan. Payment is determined through objective performance criteria established by a committee of outside, independent directors. Compensation committee certificates are required in writing and the amounts paid must reach the goals achieved. The compensation committee can decrease the payment but cannot increase based on their discretion.

These plans must be re-approved every 5 years unless it is a formula-based plan. Future proposed tax cuts and jobs acts may eliminate performance exclusion under Section 162(m).

The impact of non-recurring events on bonus programs includes restructuring charges like:

- Loss or gain on sale of assets

- Acquisitions/transaction costs

- Litigation expenses

- Changes in accounting or tax rules

- Exchange rate volatility

Discretionary Plans

Enhanced disclosure requirements caused a shift away from discretionary plans towards more formulaic “cookie-cutter” approaches. Discretion takes courage and it can be difficult to describe and rationalize or defend these decisions publicly.

Discretionary plans are viewed negatively by the ISS. Adjustments or modifications to the established plan are often viewed as moving the goalposts. Companies and committees are returning to the concept in recent years due to economic volatility and associated challenges with setting performance targets. Discretion is a valuable risk mitigation tool in many situations, especially with recent currency fluctuations. The size of recent currency fluctuations has impacted corporations with global operations. Committees are now focused on the extent to which management should be held accountable for a factor largely outside their control.

Companies have adopted several approaches to adjustment including:

- No adjustments

- Corridor approach (exclude impact outside of a predetermined range, i.e. 110/15%)

- Fully neutralize

- Board discretion

- Adjustments determined on a case-by-case basis

Some companies have also moved more explicitly to constant currency disclosure in CD&A and other IR documents.

Sharing Ratios

How much of the profits should you be giving away? An alternative way that measures bonus program design elements is to analyze the slope of payout curve, threshold, target, and maximum payout levels. Another way to assess pay-for-performance alignment includes succession planning. We now see compensation plans using the annual incentive plan to support succession planning goals for the current CEO and also for highly regarded talent.

There is, however, a disconnect between short-term results and stock price.

We recommend businesses use a mix of performance metrics. They should all provide an appropriate and balanced focus on achieving those strategic key objectives and making sure you have enough so that you can retain executive talent. Reevaluate your plans on a regular basis. Just because you put something in place now doesn’t mean it has to stay that way forever. Plans need not remain static. Companies should periodically review plans to ensure they continue to support the organization’s strategic objectives. Maybe the plan changes. You could change your mind on what the key metric is. The world changes all the time. Make sure your plan and strategy coincide.

Understand the ramification of those changes. If you’re making any types of substantial modifications, make sure you understand the legal and accounting ramifications. Also understand what will get under shareholder advisory services firms, what your shareholders want to know about, and how you need to address those changes.

Assess risks: This is important. Make sure performance targets are attainable and fair to both executives and shareholders. You don’t want people reaching too far beyond their means and doing risky things that put the company at material risk to achieve payouts. It’s great to have max goals, but you don’t want them to be unattainable because they can drive people to do risky things. You don’t want to encourage employees to take on excess risk. They should be thoughtfully selected and complementary with other goals used in your entire program, both short and long-term sides.

Communicate: If you want any incentive program to really succeed, you need to communicate it to your participants, which will be critical in making sure that it’s successful. It also must be communicated to all of your stakeholders, both internal and external.

Last but not least, don’t simply follow the herd. You don’t need to do what everyone else is doing. Do what you believe. If you have a metric that isn’t that popular out there, but you believe is a driver of shareholder value and will deliver that value, go with it. If no one else is using it, that’s not the perfect reason to not use it yourself. Believe in what you’re doing. If TSR isn’t what you want to focus on, just move on and do what you believe will drive that TSR. That’s our key – do what you believe in, what aligns with your strategy, not simply following what others do.